Rentvine Owner Portal Instructions

Welcome to our comprehensive guide for the Rentvine Owner Portal. Select the instruction set that matches your current needs.

Please select an instruction set below:

Rentvine Owner Portal Introduction and Making Owner Contribution

Watch Video Tutorial

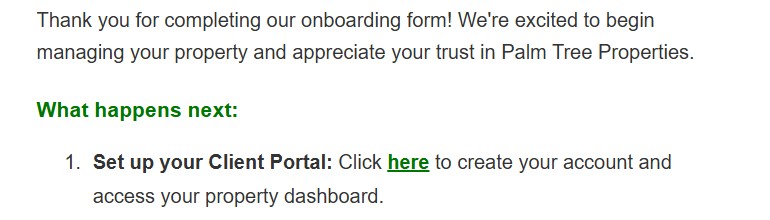

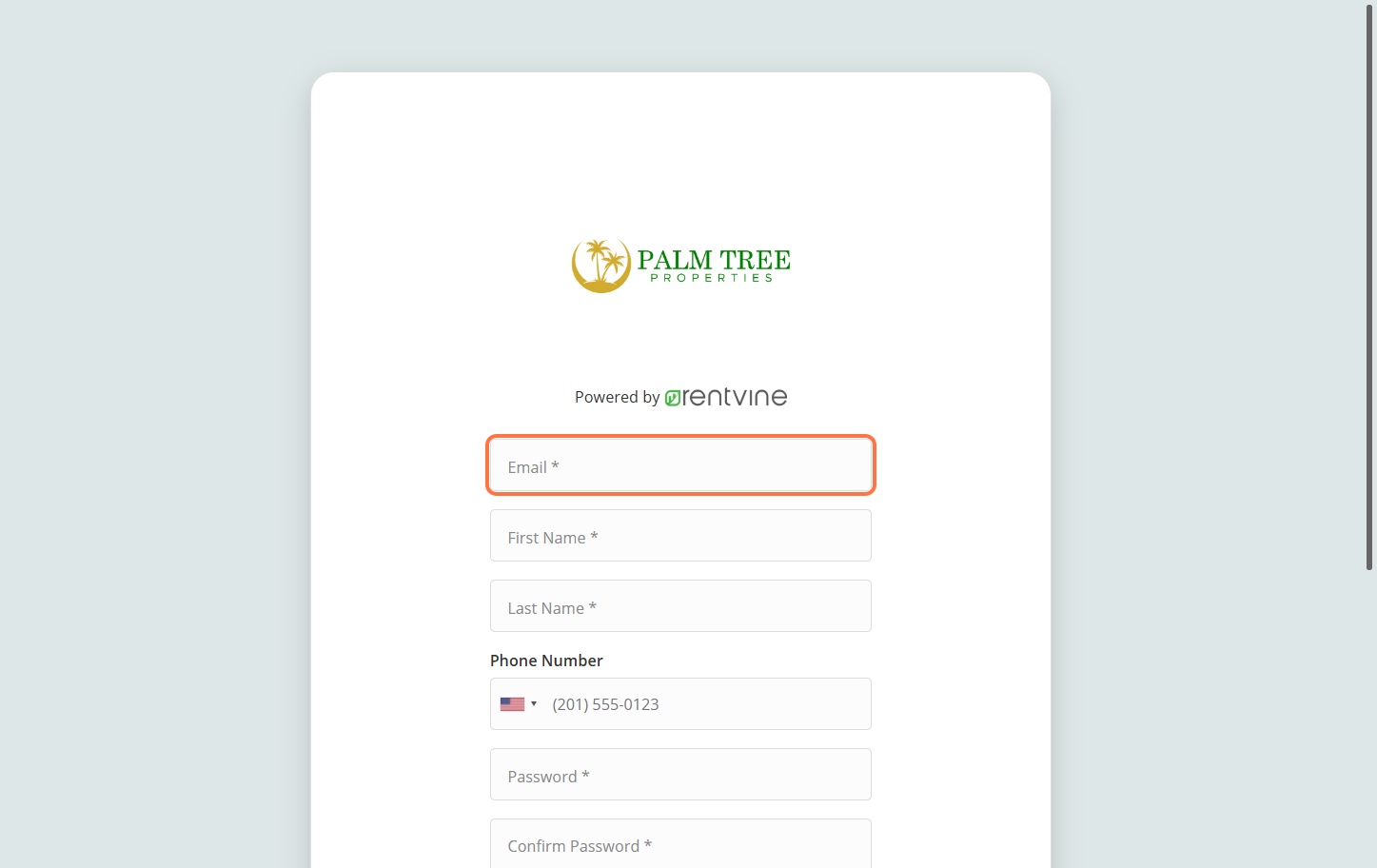

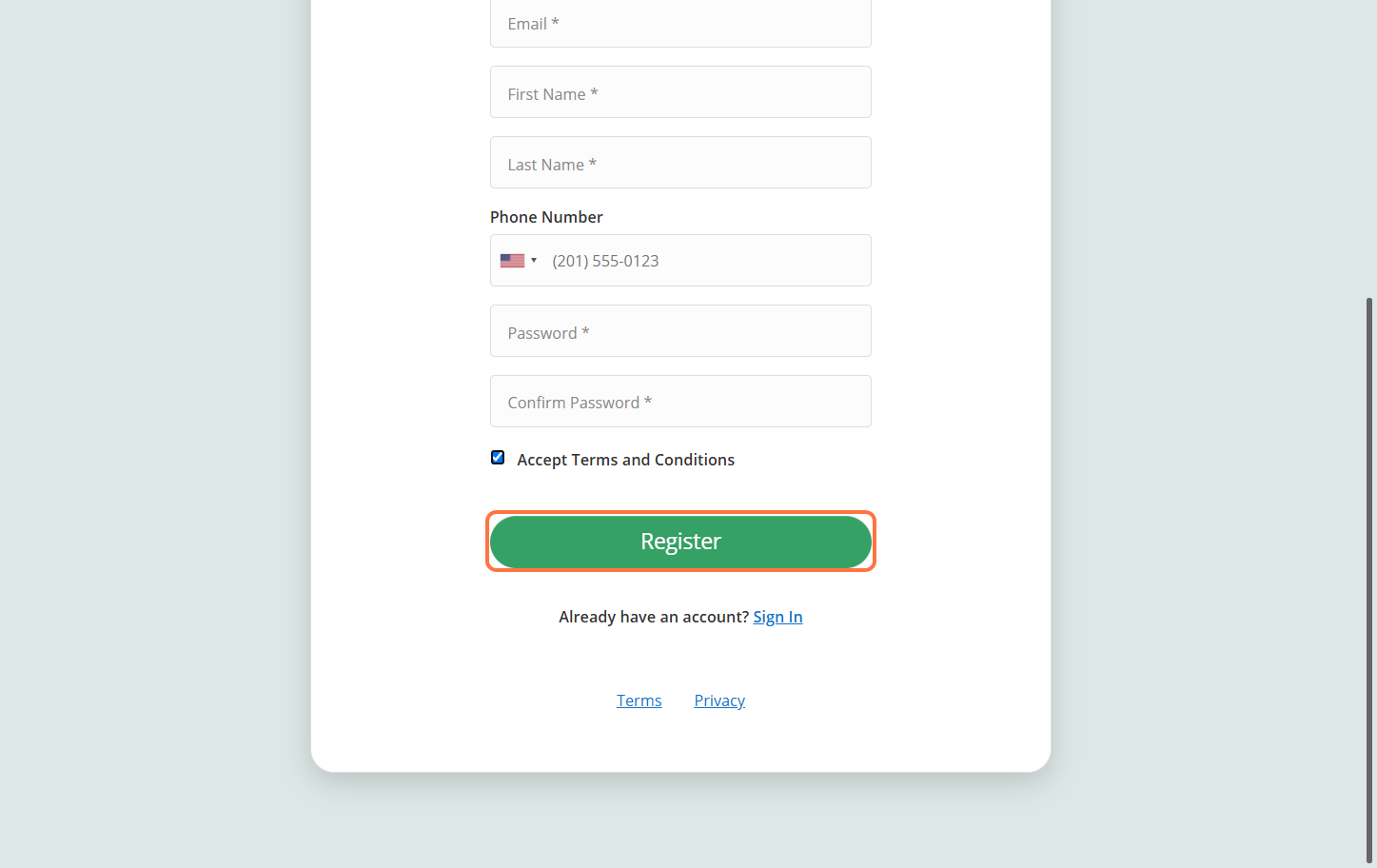

Click the link provided in the “Onboarding Form Received” confirmation email to begin the registration process.

Provide all required information in the registration form to create your account.

Click the “Register” button to complete your account creation.

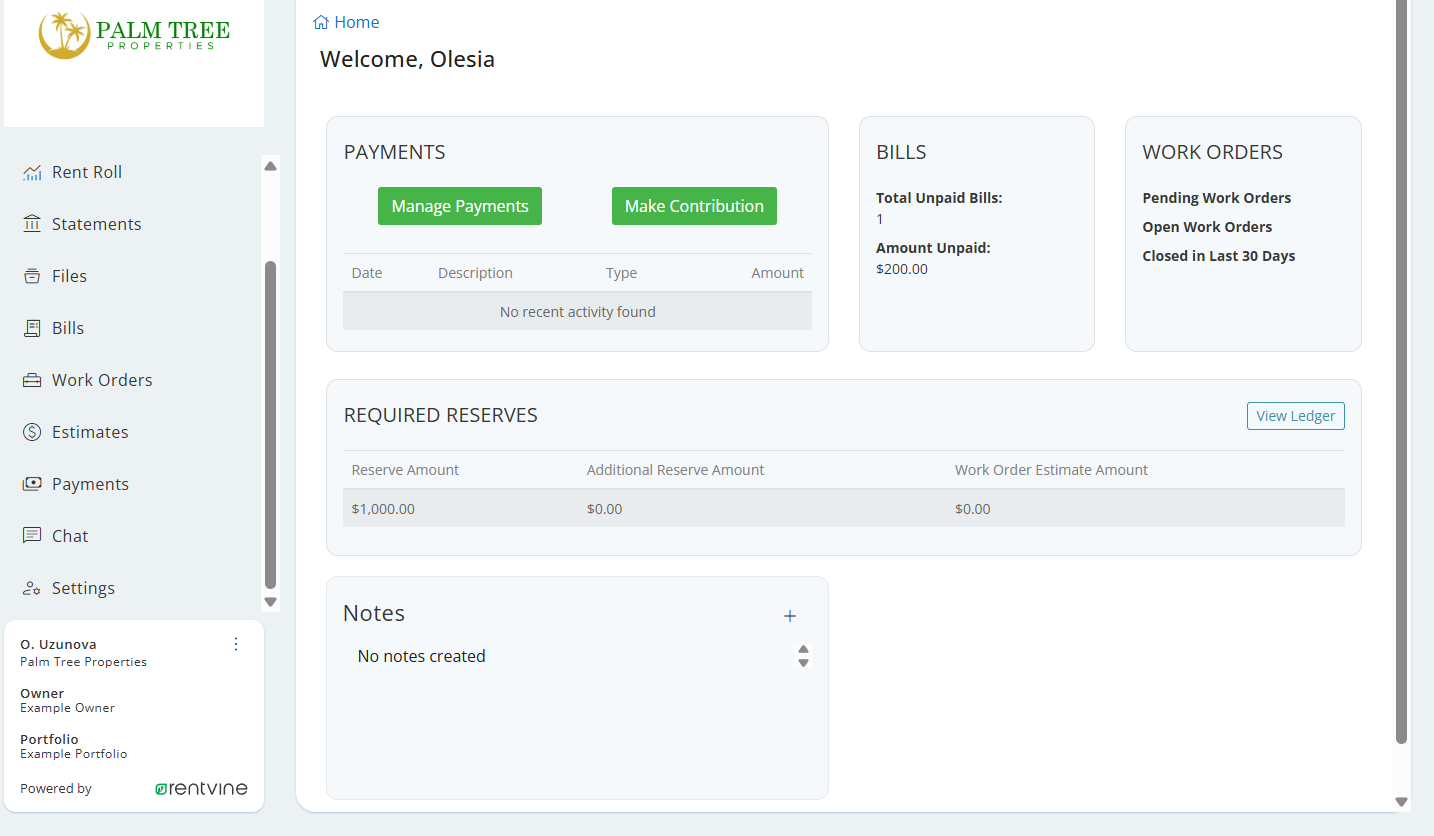

Once logged in, you’ll see the main dashboard of your Rentvine owner portal. Take a moment to familiarize yourself with the layout.

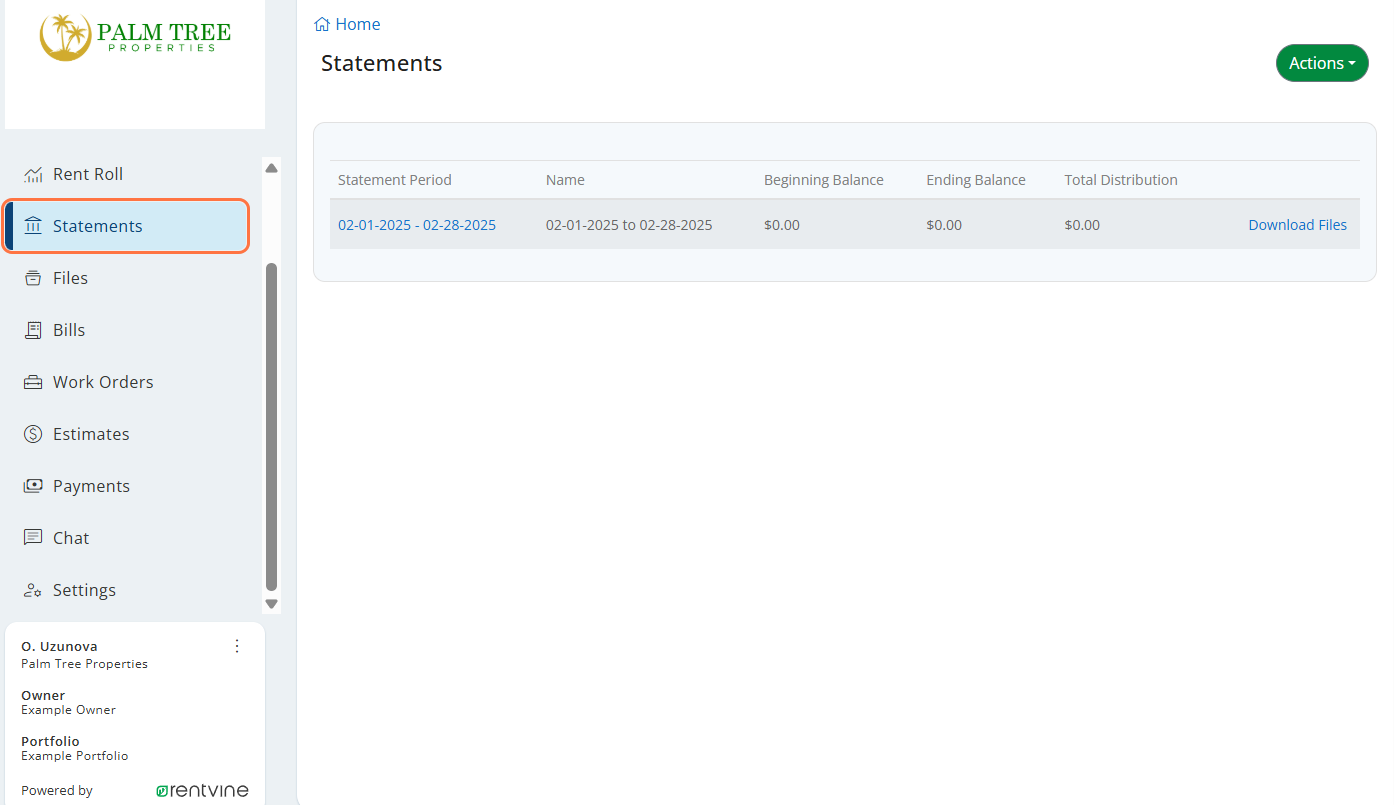

Navigate to the “Statements” section to view your monthly statements. You can view or download statements by clicking the corresponding action buttons.

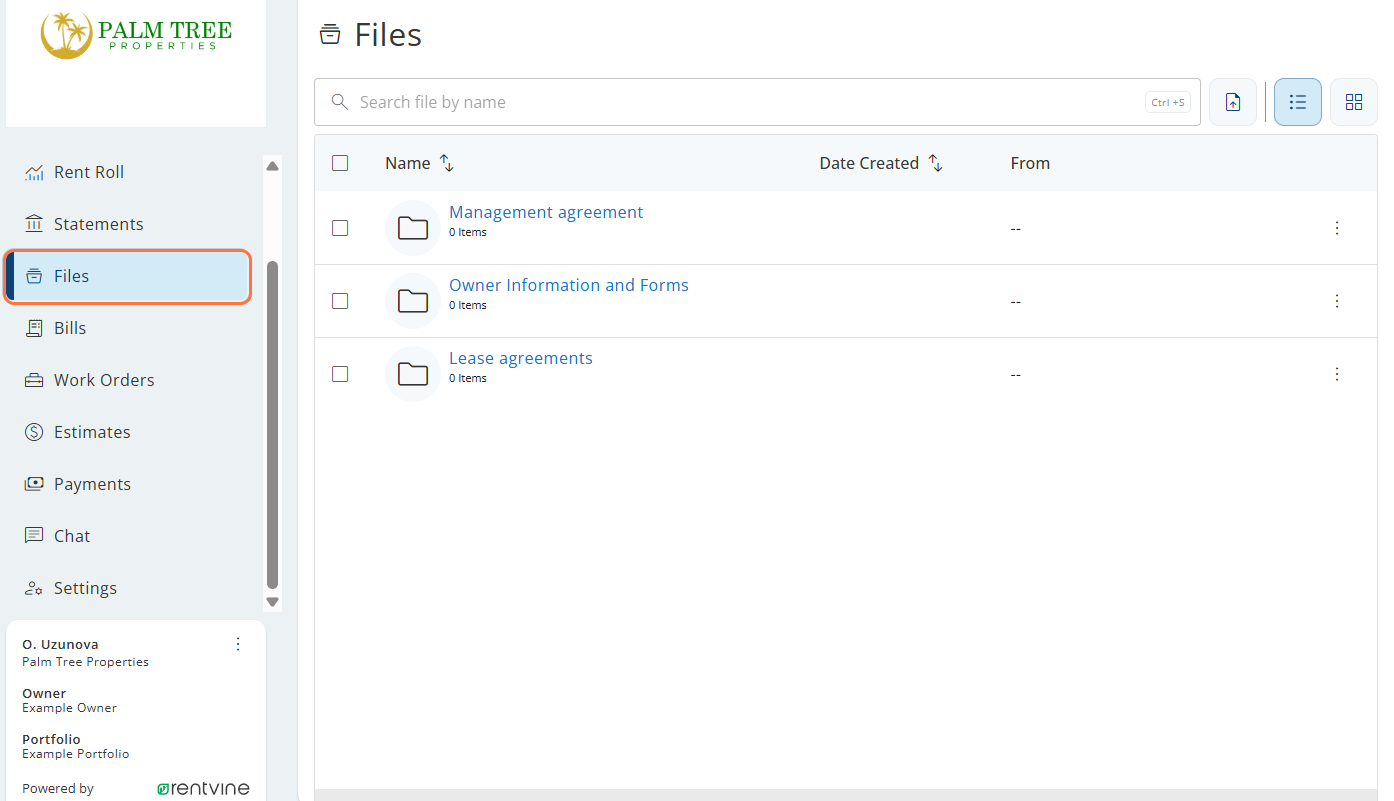

Find important documents and files shared with you in the “Files” section.

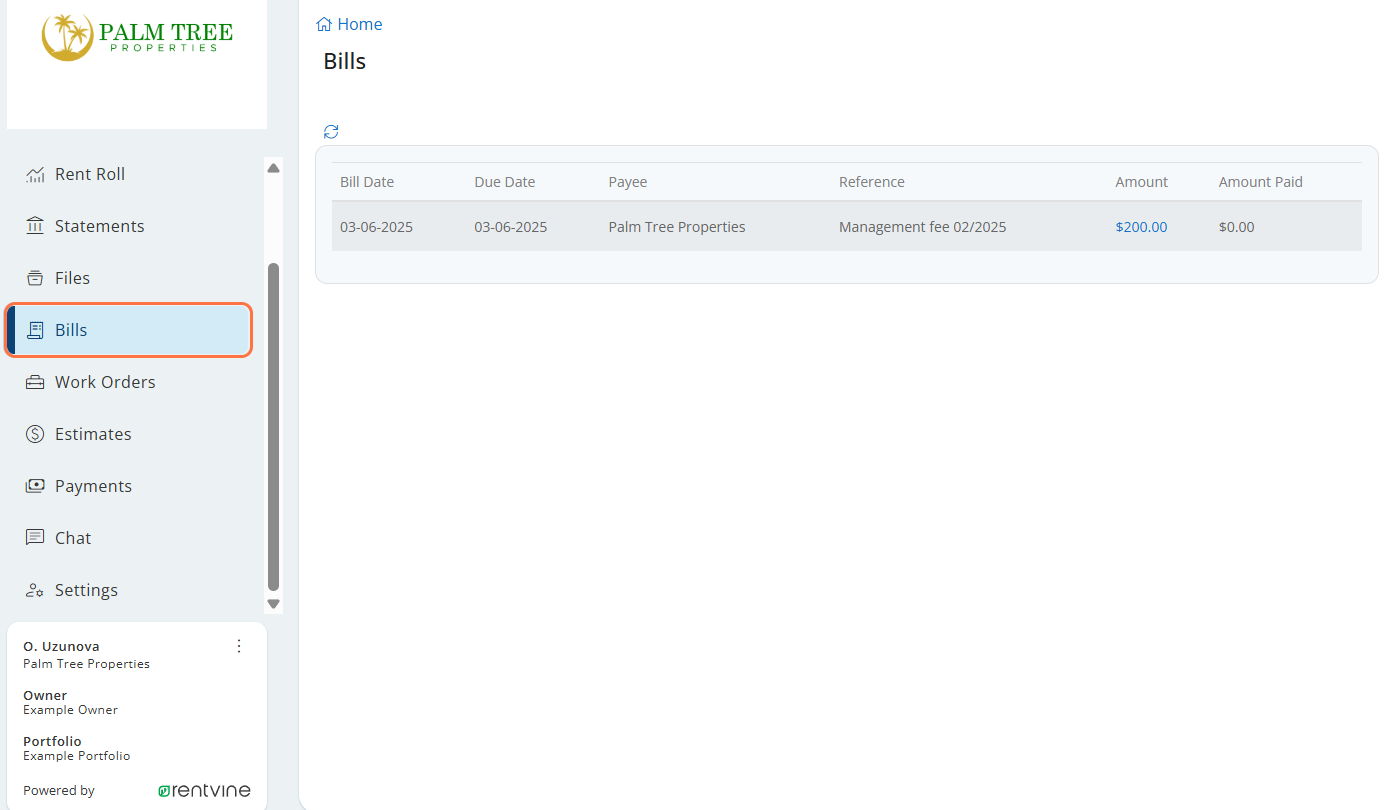

View paid and unpaid bills and charges in the “Bills” section.

Navigate to “Chat” to reach out to your Property Manager. Simply type and send your message to start a conversation.

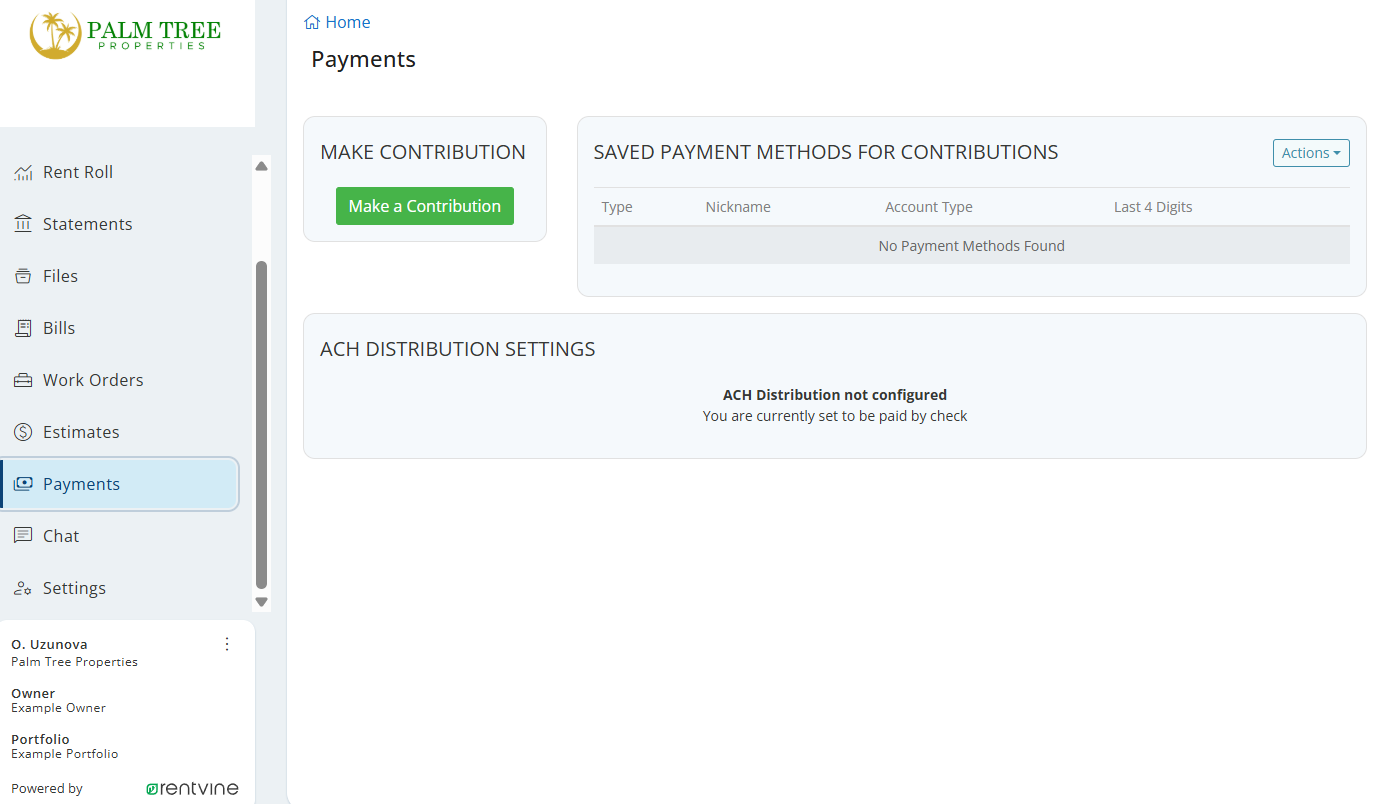

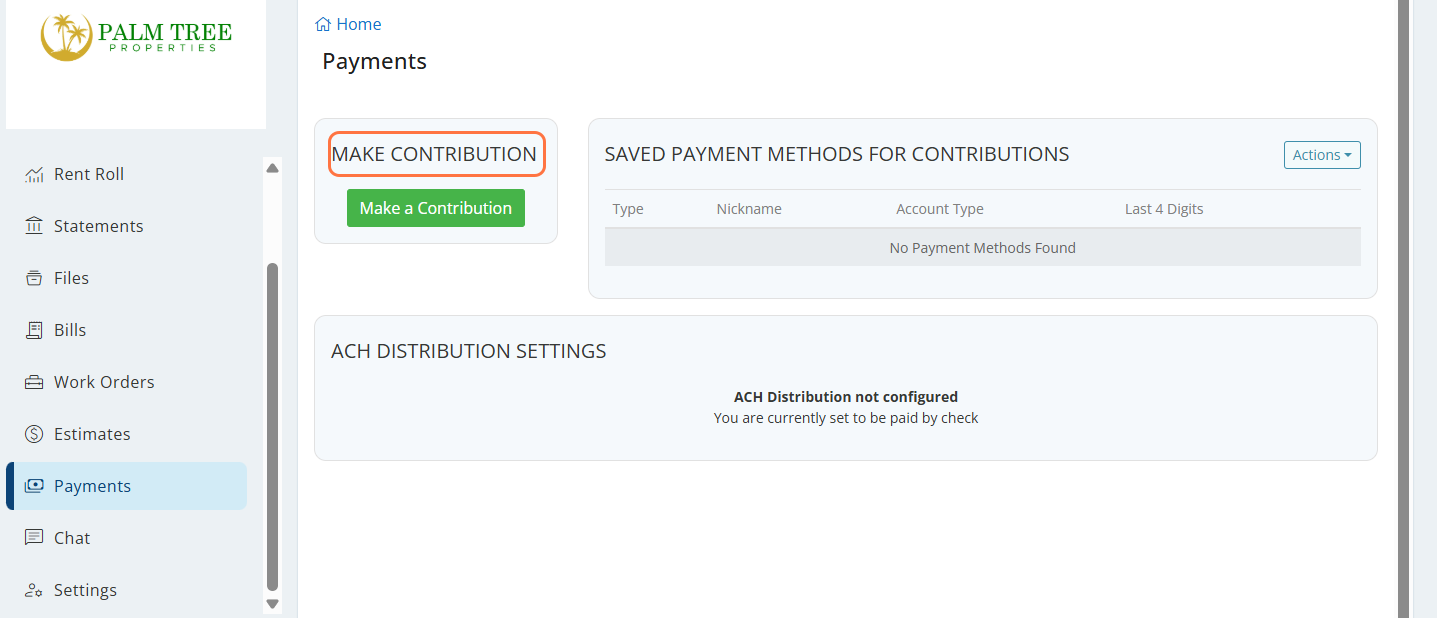

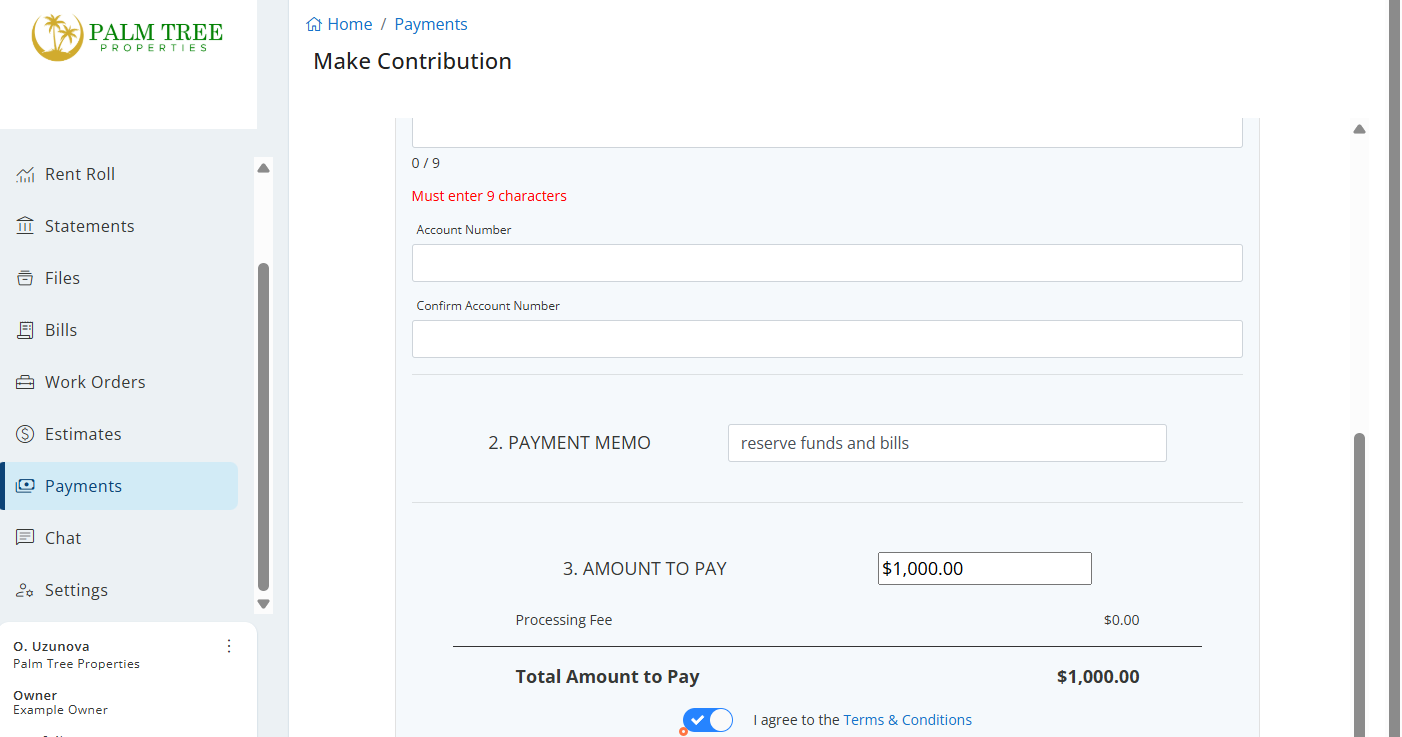

Navigate to the “Payments” section to make a contribution or save a preferred payment method.

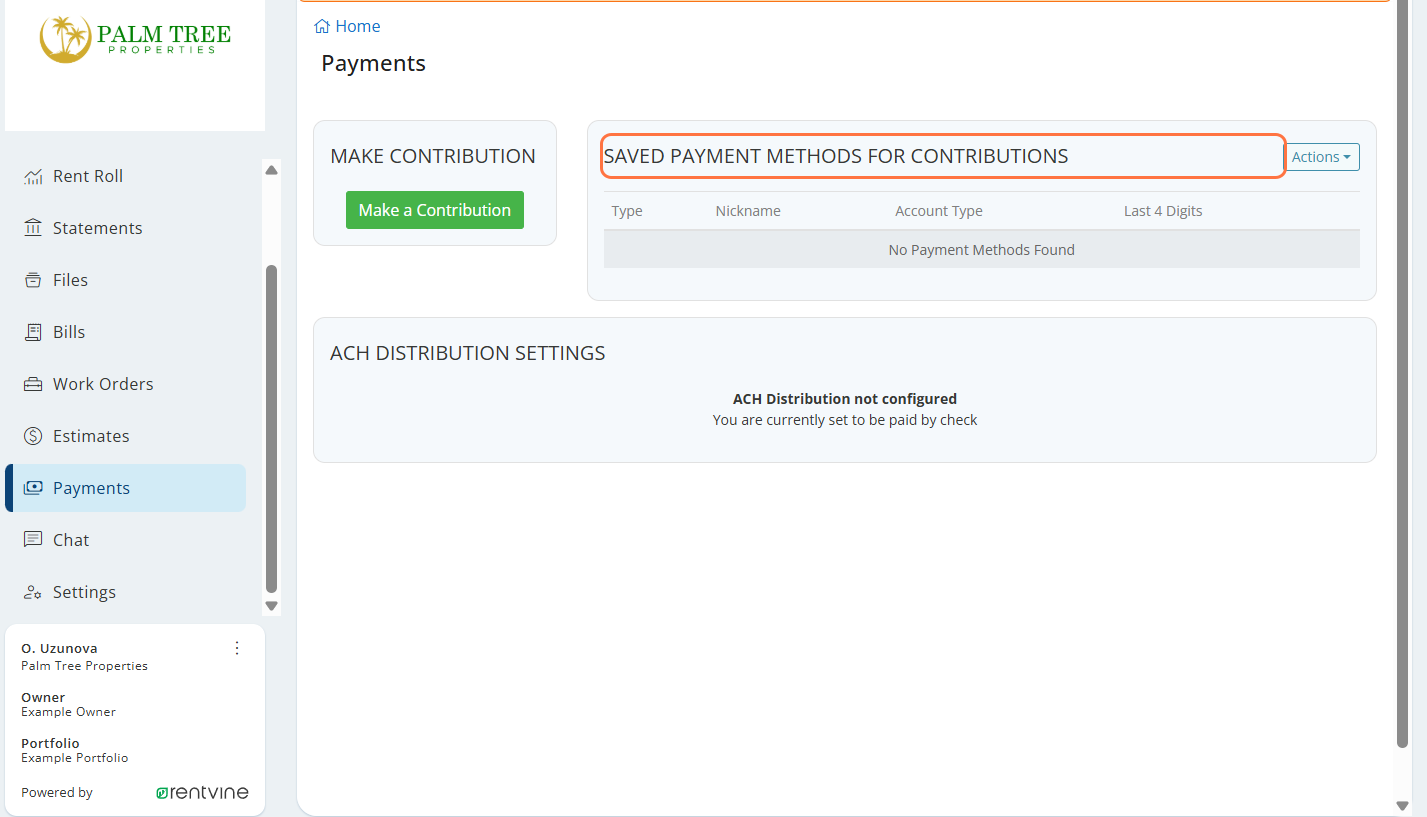

Click on “SAVED PAYMENT METHODS FOR CONTRIBUTIONS” to set up a preferred payment method for future use.

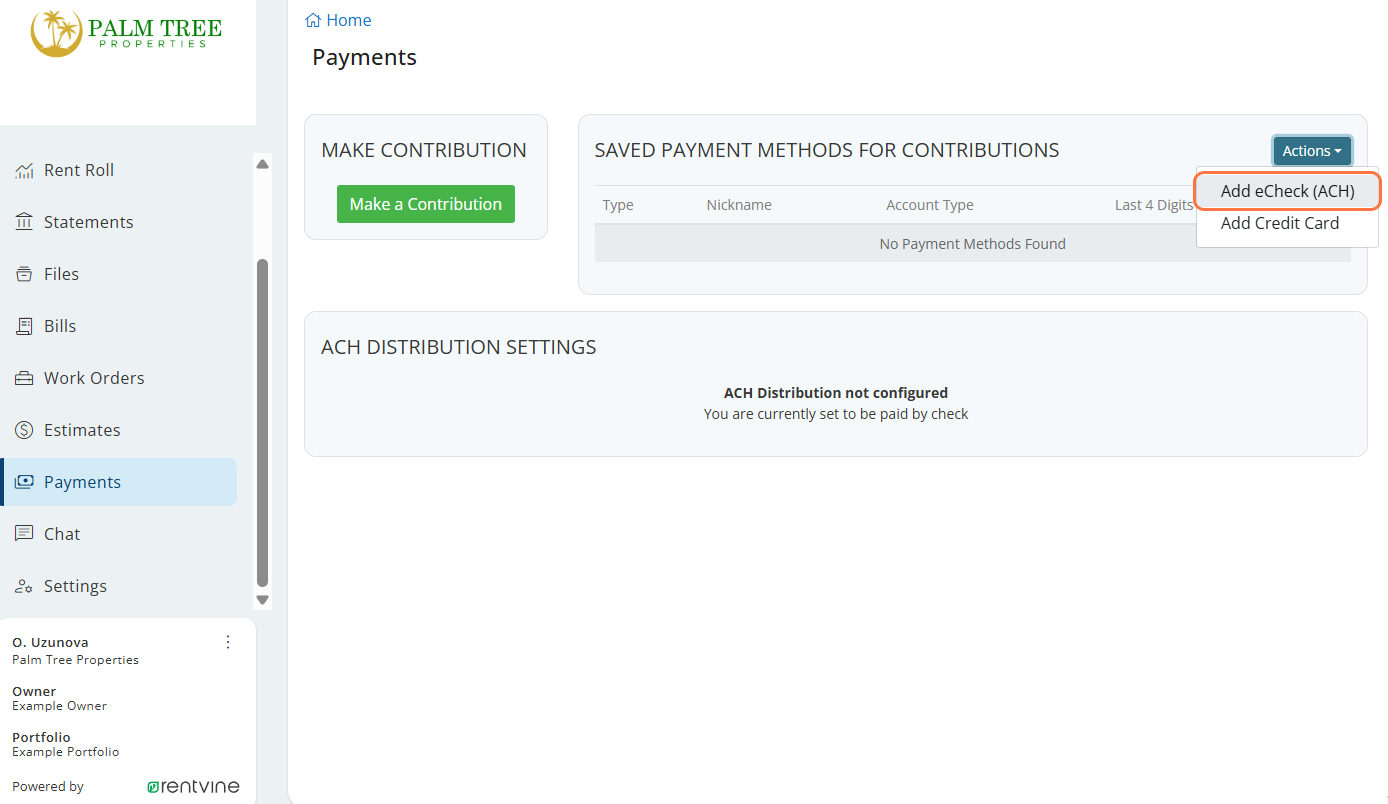

In Actions, select “Add eCheck (ACH)” to enter your bank account information for easy contributions.

Click on “MAKE CONTRIBUTION” to initiate a one-time contribution to your property.

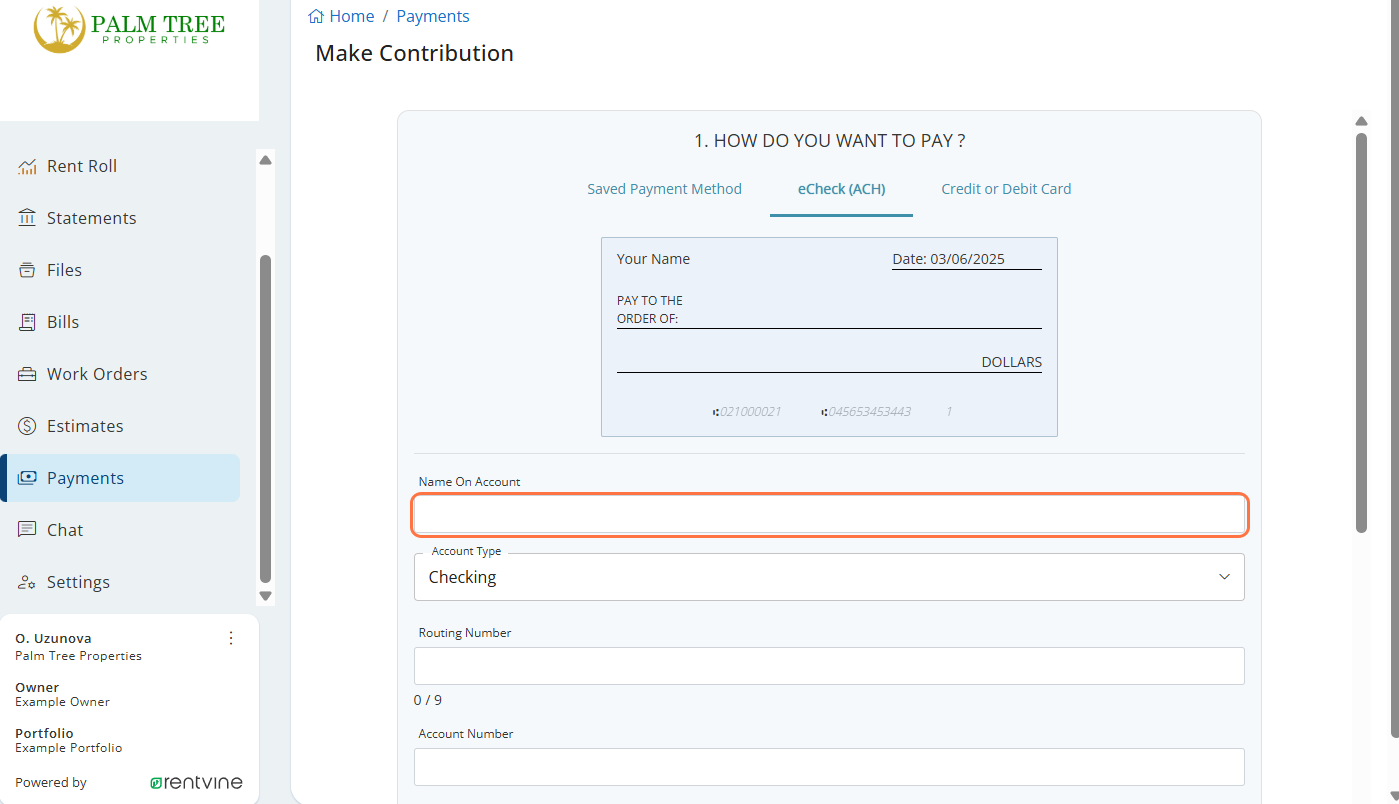

Choose your preferred payment method:

If using eCheck (ACH), enter your account information:

- Account number

- Routing number

- Account type (checking or savings)

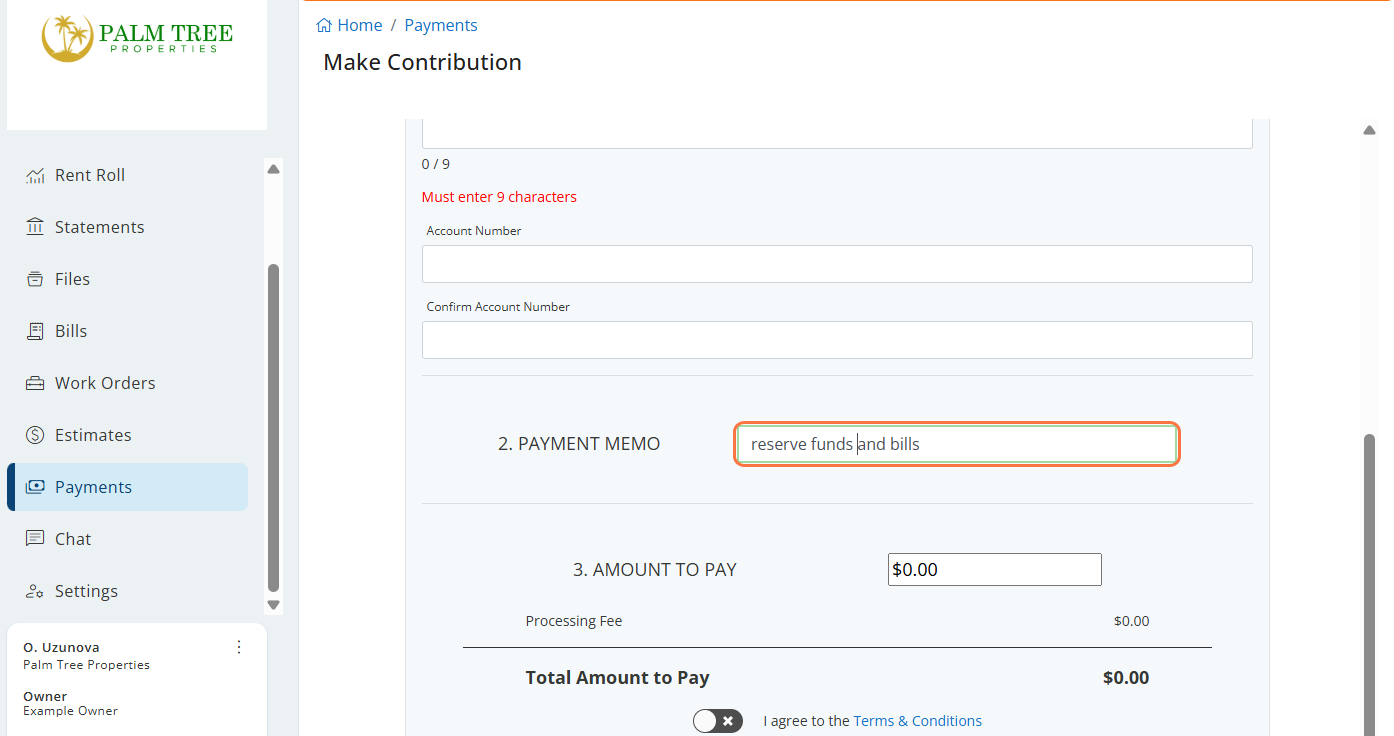

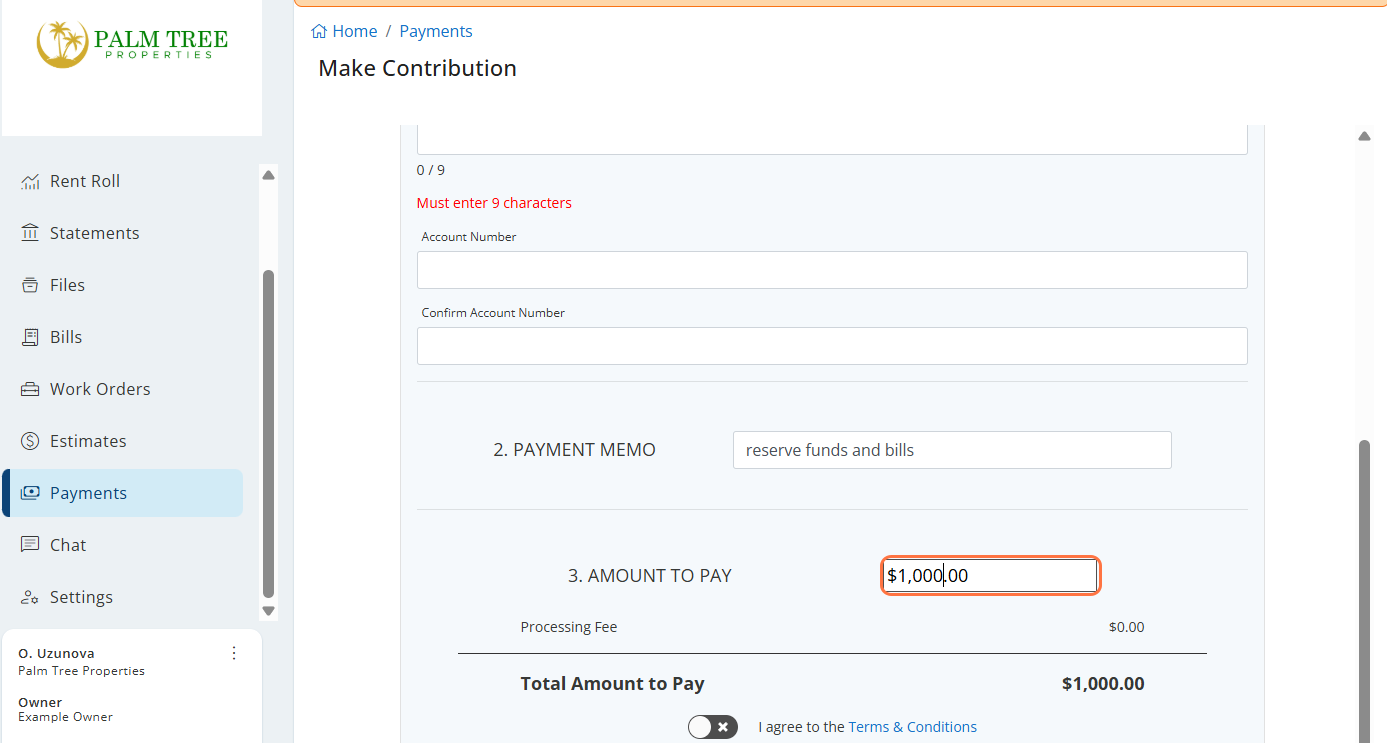

In the MEMO field, provide details about what the contribution is for to help with record-keeping.

Enter the contribution amount you wish to make.

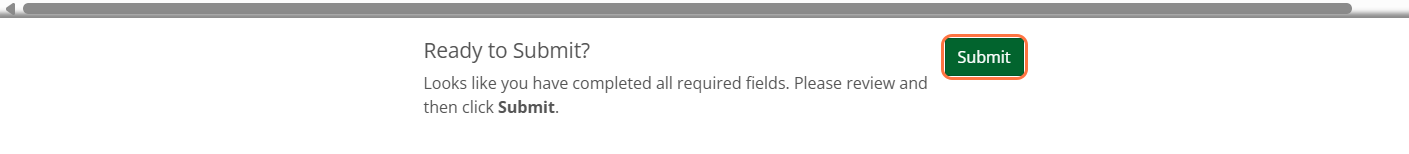

Toggle the confirmation switch ON and click “Submit” to complete your contribution.

Signing ACH and W-9 Forms in Rentvine

Watch Video Tutorial

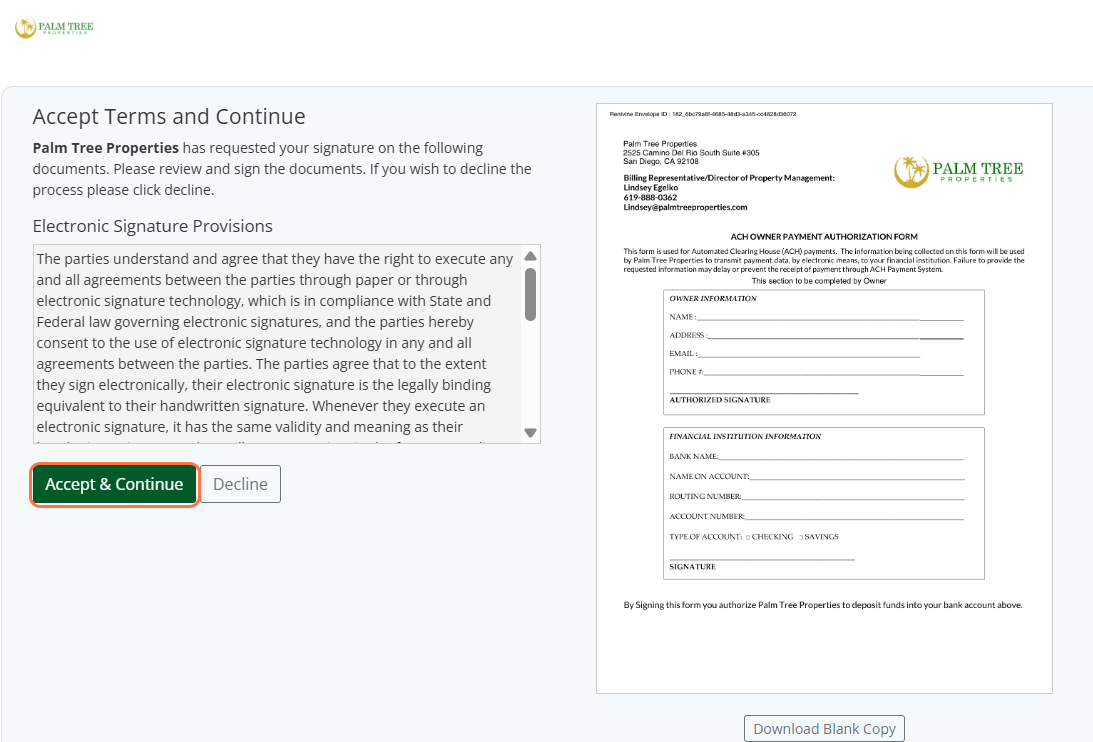

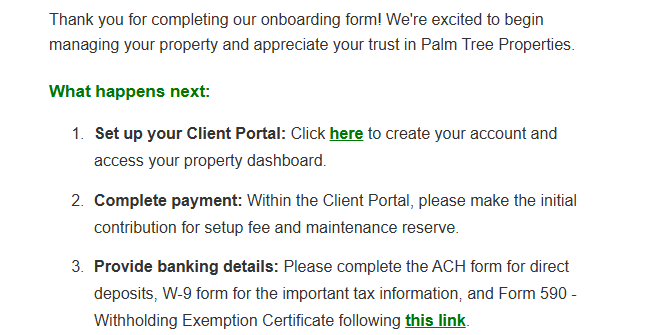

Click on the link provided in the “Onboarding Form Received” confirmation email to access the form signing page.

Review the document information and click on “Accept & Continue” to proceed.

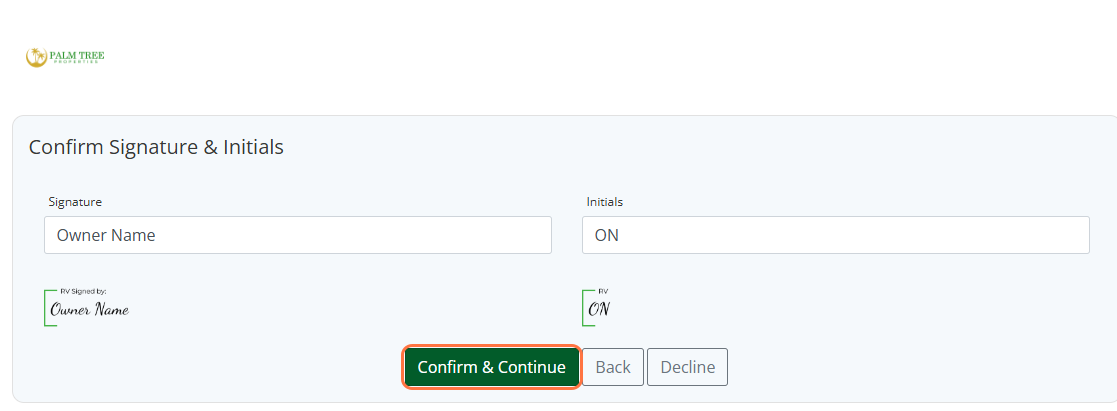

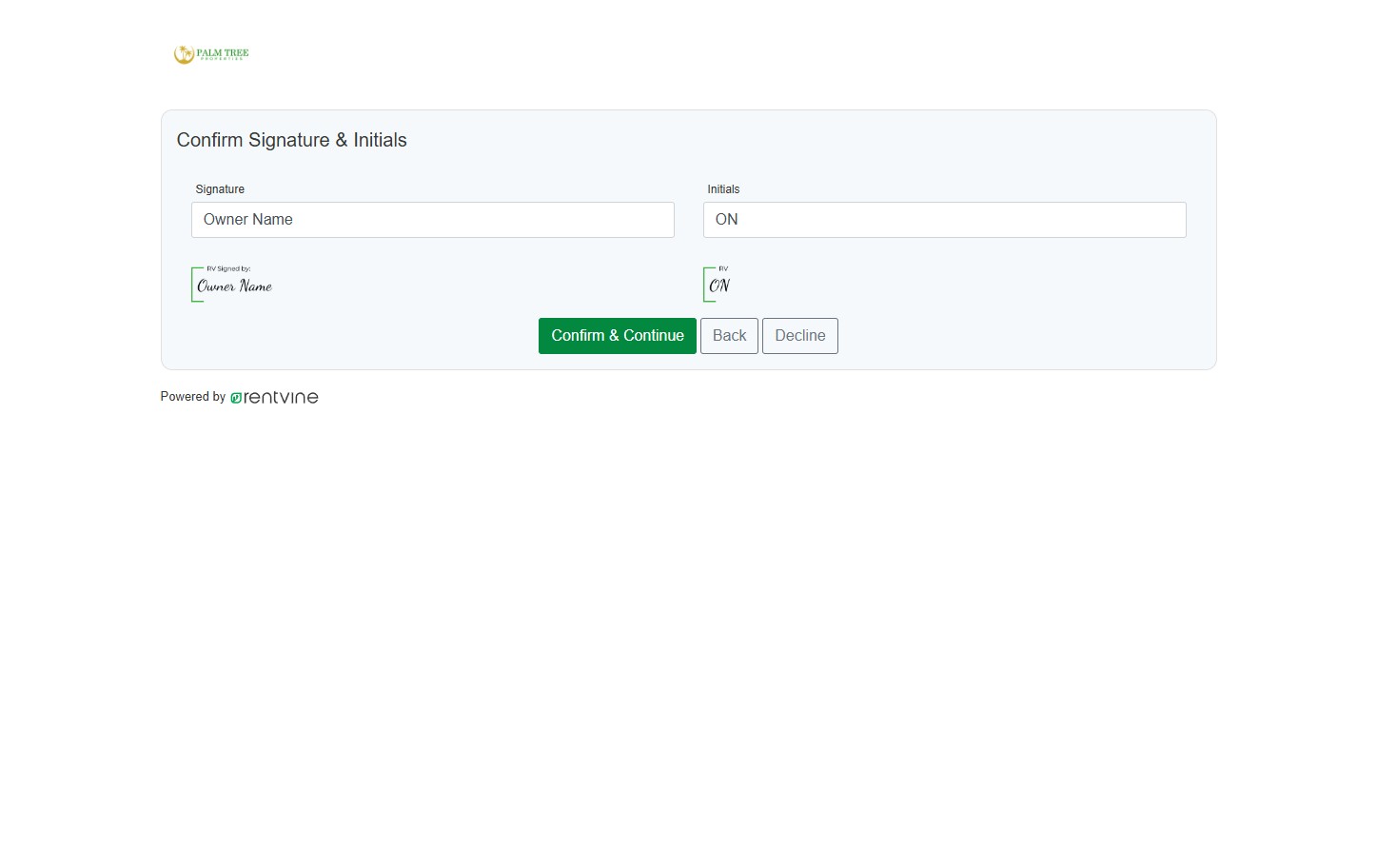

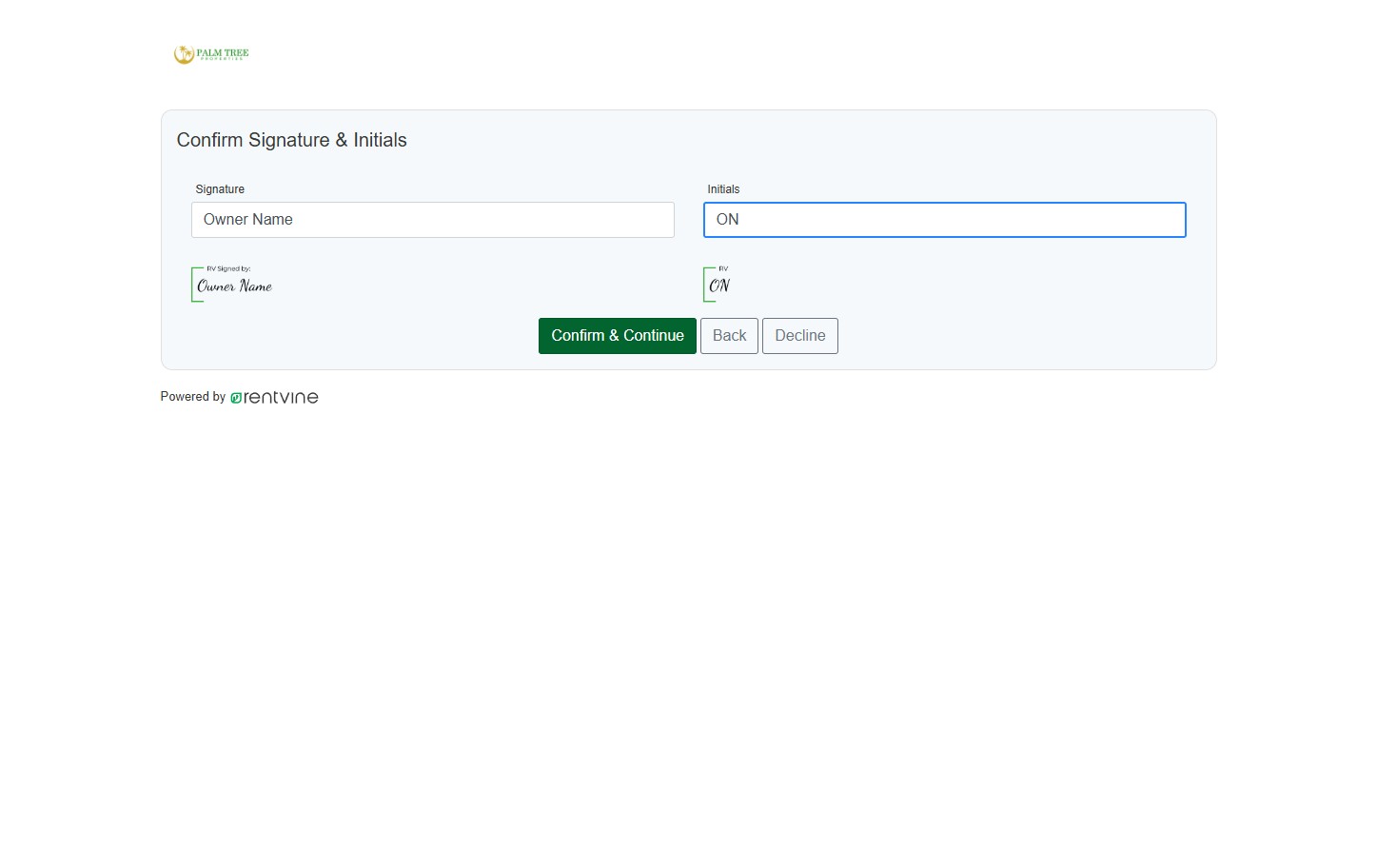

Review your signature and initials, then click on “Confirm & Continue”.

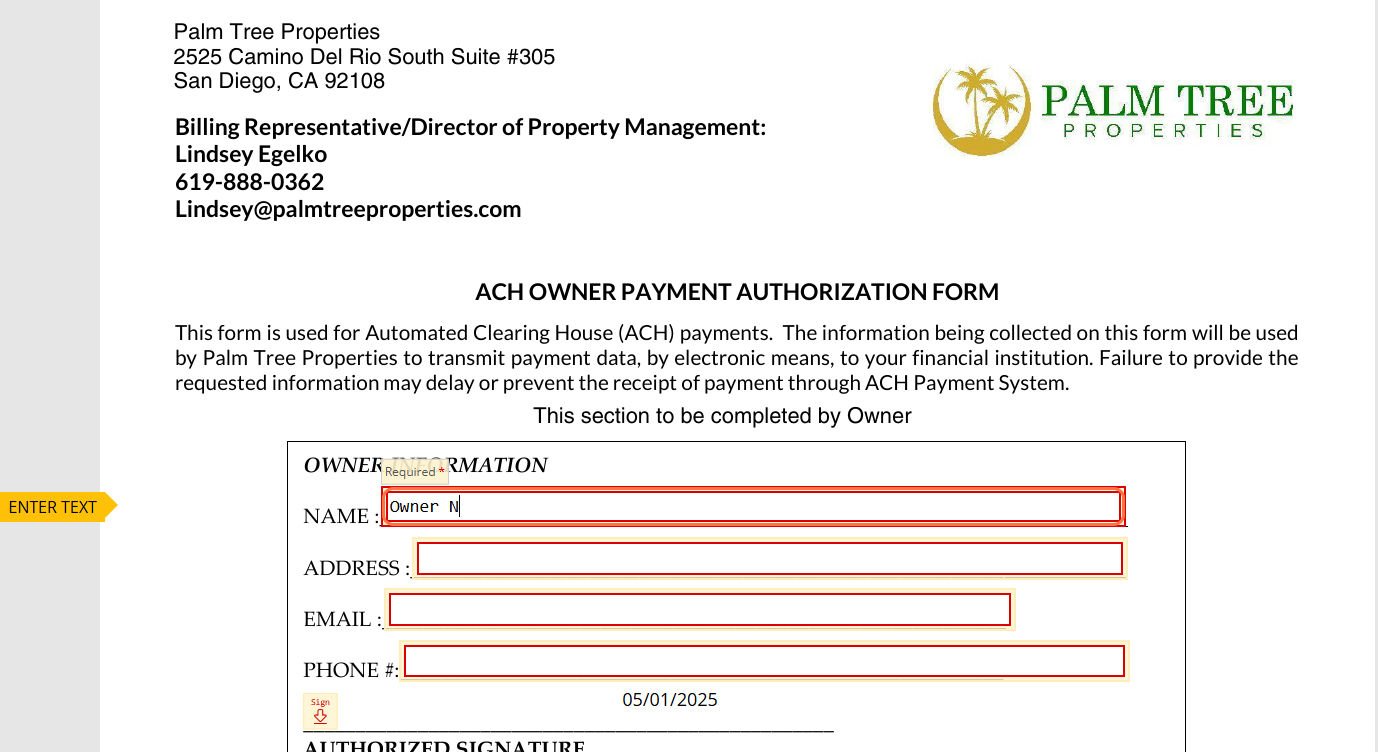

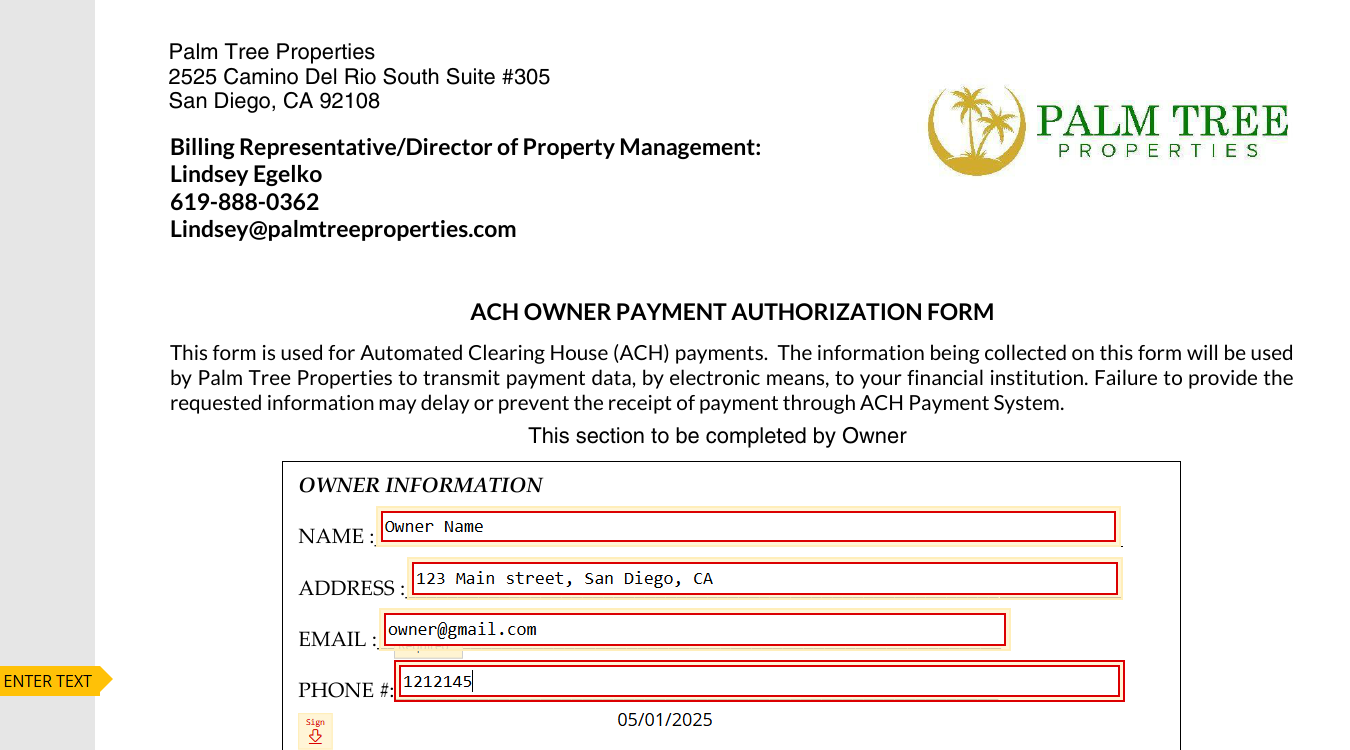

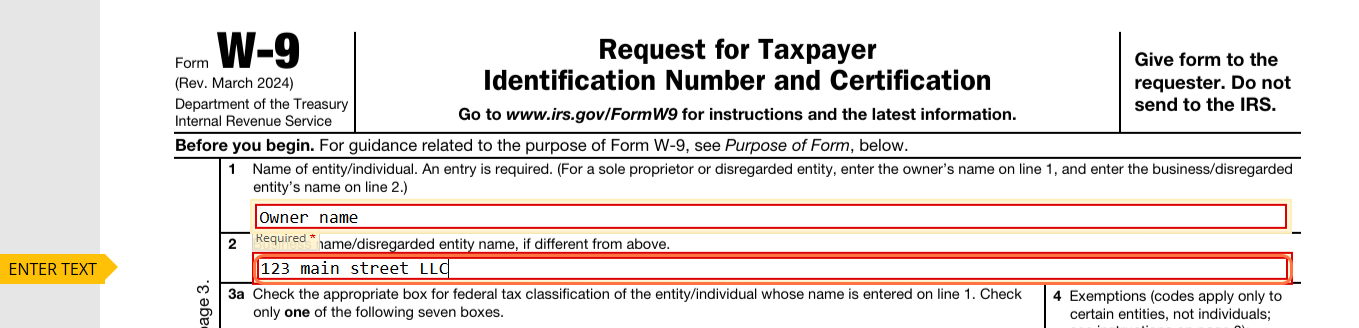

Type your full name, address, email, and phone number in the designated fields.

Click on the Sign button to apply your signature to the ACH form.

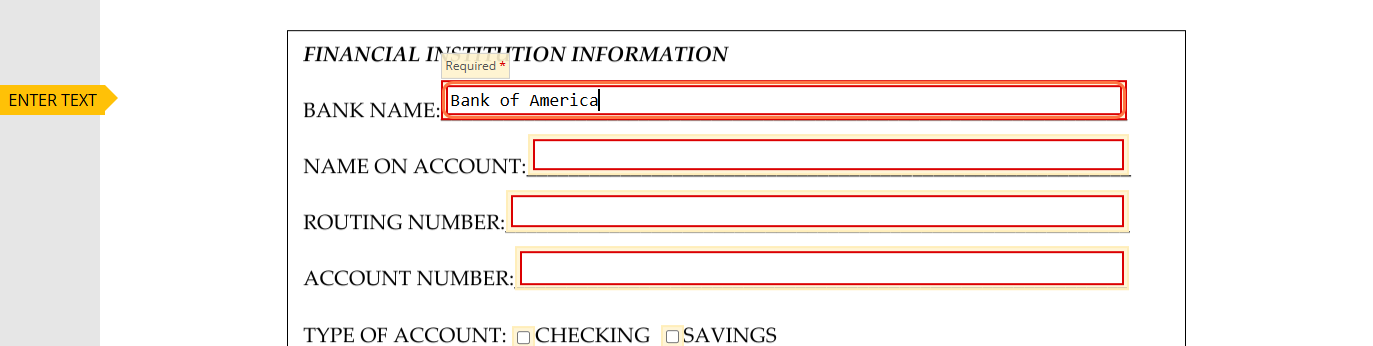

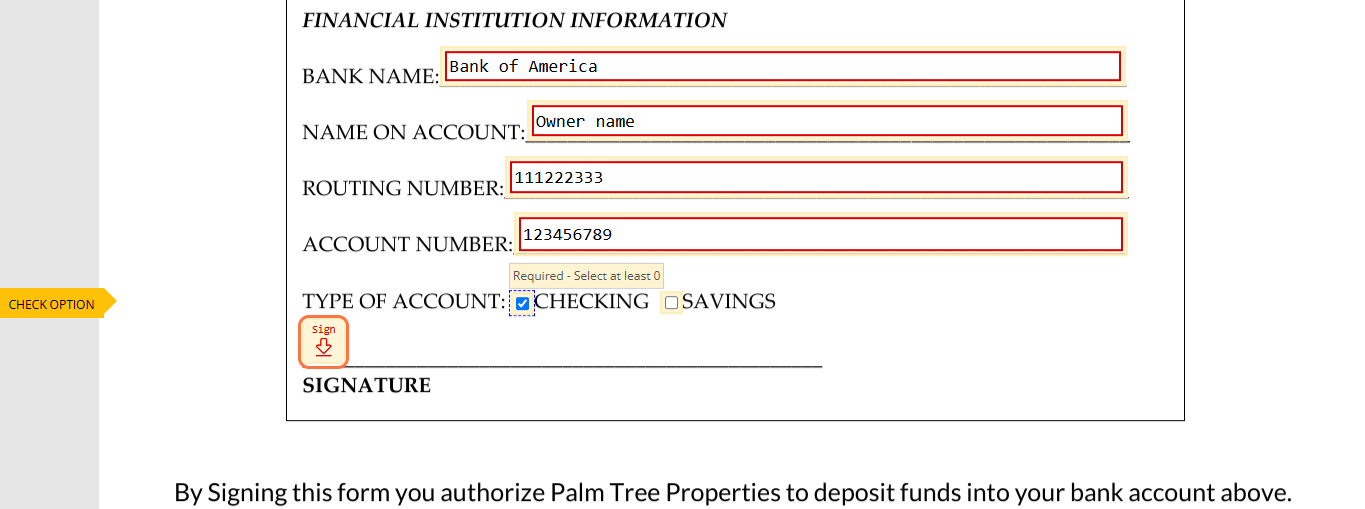

Enter your bank information:

- Bank name

- Name on the account

- Routing number

- Account number

- Account type (checking or savings)

Carefully verify all banking information is correct before proceeding.

Click on the Sign button to finalize the ACH form section.

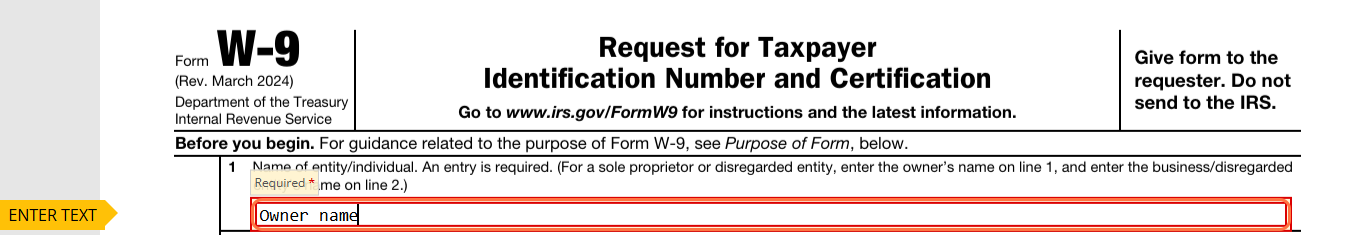

Enter your full taxpayer’s name as it appears on your tax returns.

Provide your business name if applicable and if different from the taxpayer’s name.

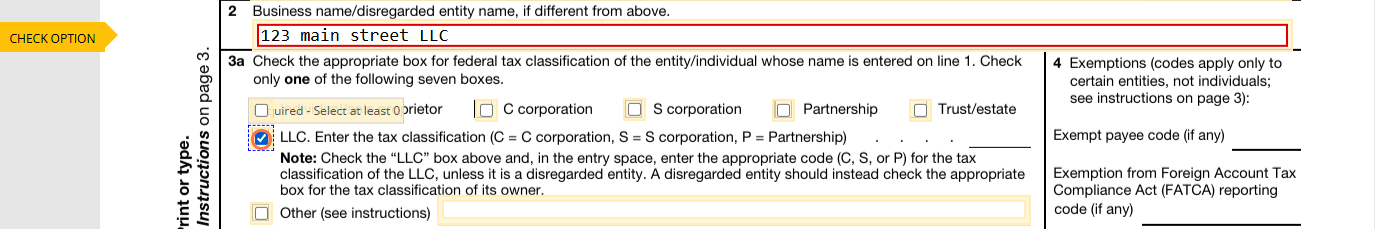

Specify your taxpayer type by selecting the appropriate option (Individual, Sole proprietor, Corporation, etc.).

Provide your complete address information.

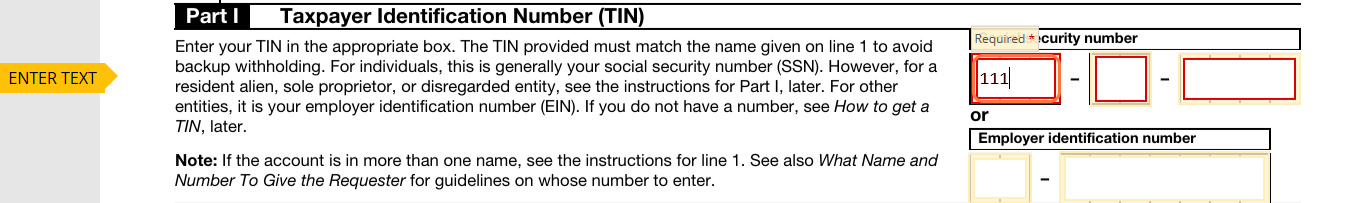

Provide your Social Security Number (SSN) or Employer Identification Number (EIN):

- If providing an EIN, enter “N/A” in the SSN field

- If providing an SSN, enter “N/A” in the EIN field

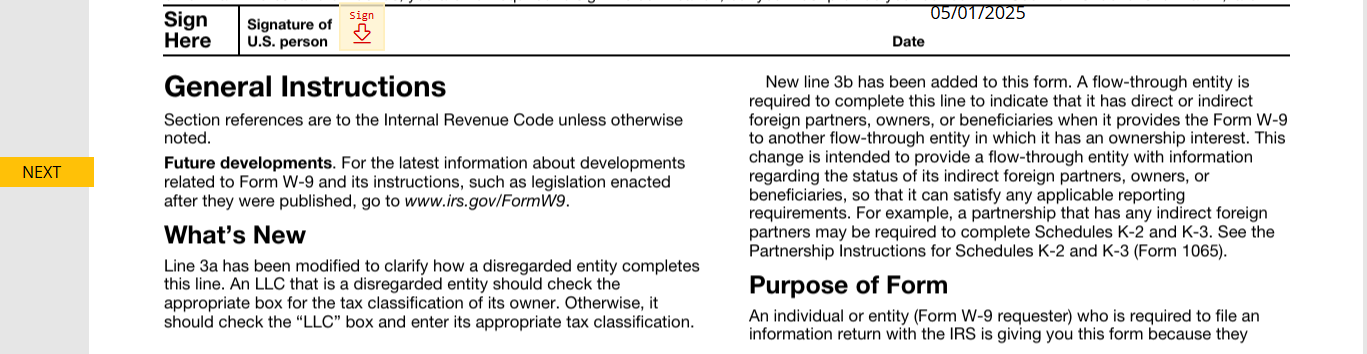

Click on the Sign button to apply your signature to the W-9 form.

Click on the Submit button to finalize and submit both forms.

Warm regards,

Palm Tree Properties

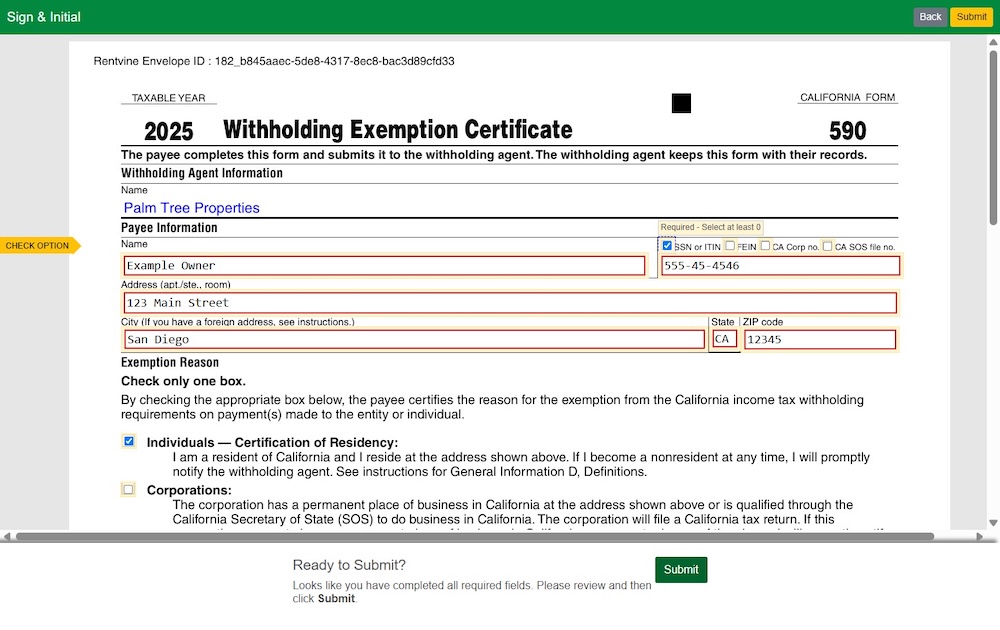

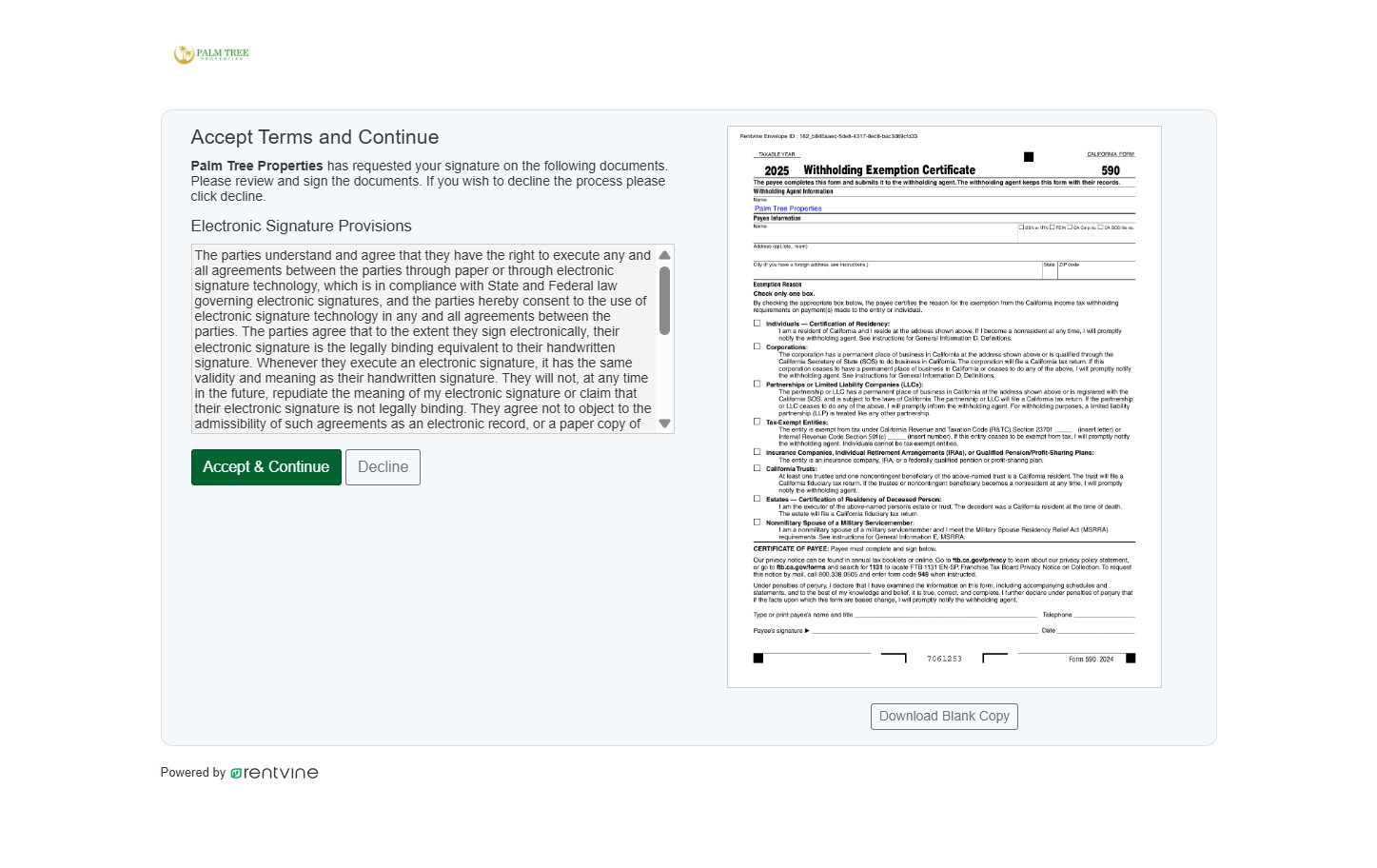

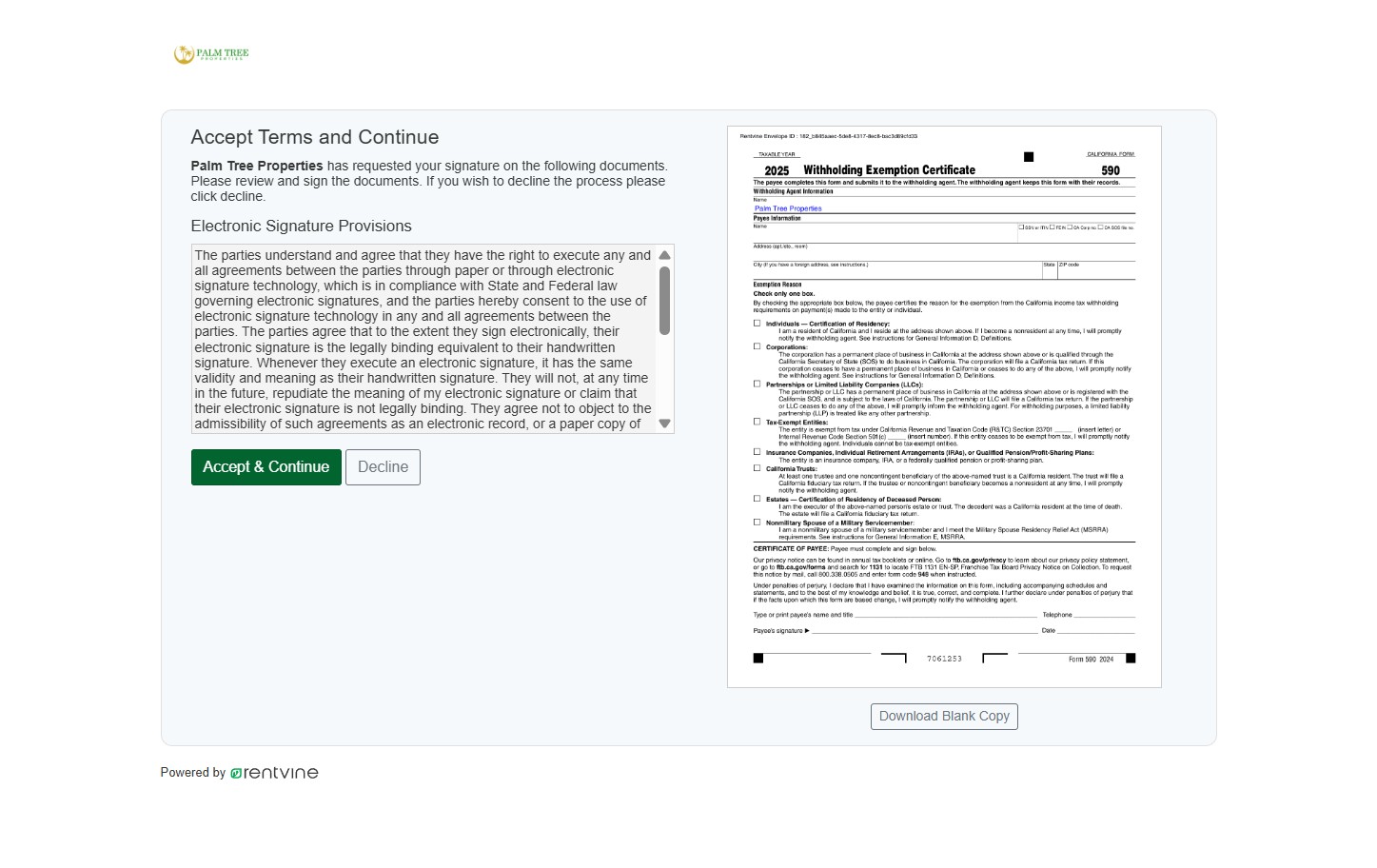

How To Complete Form 590 – Withholding Exemption Certificate

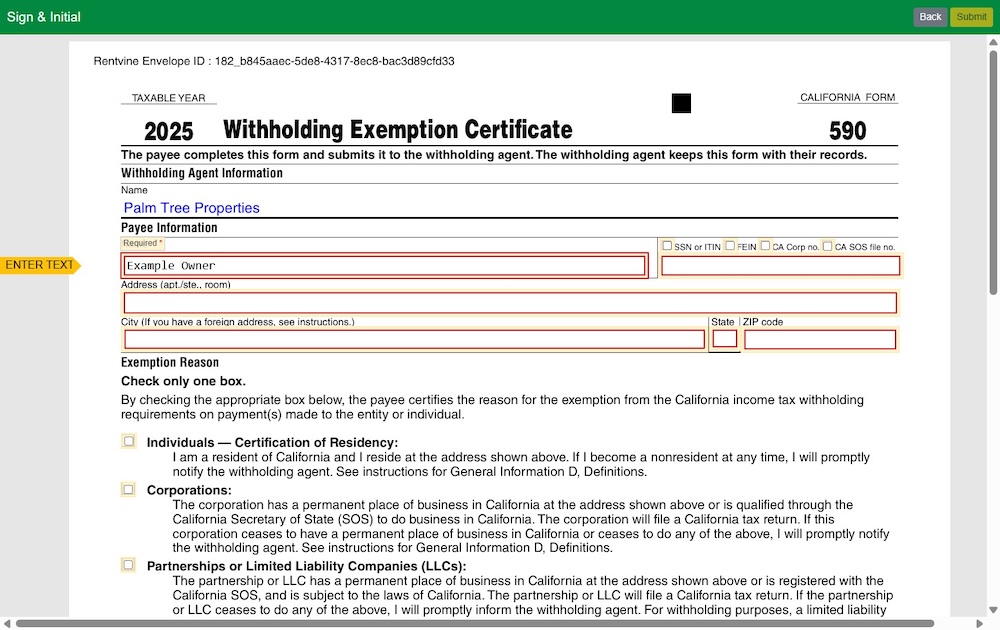

Click on the link provided from Rentvine to sign the required Form 590 document.

You will be directed to the Rentvine platform where you can access and complete the Form 590.

After reviewing the provisions, click “Accept & Continue” to proceed with the form completion.

Verify that your full name and initials are displayed correctly before proceeding.

After reviewing your information, click “Confirm & Continue” to move forward.

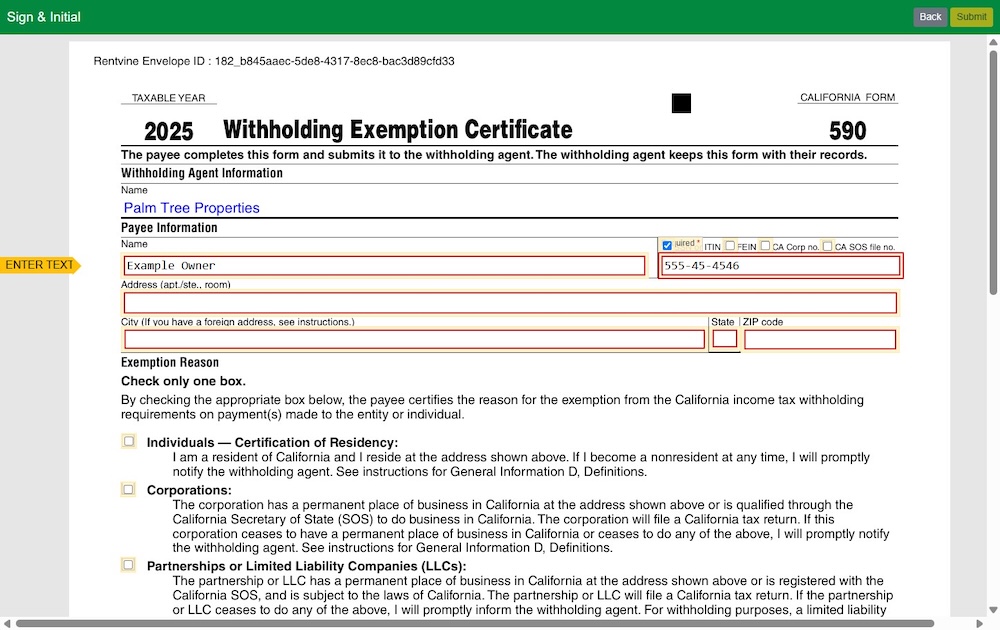

Enter your full name or the full name of the organization in the designated field.

Select which type of identification number you will provide:

- SSN/ITIN (Social Security Number / Individual Taxpayer Identification Number)

- FEIN (Federal Employer Identification Number)

- CA Corp. no (California Corporation Number)

- CA SOS file no. (California Secretary of State File Number)

Choose the one that applies to your situation.

Type the identification number you selected in the previous step (SSN/ITIN, FEIN, CA Corp no. or CA SOS file no.).

Enter your complete address in the state of California.

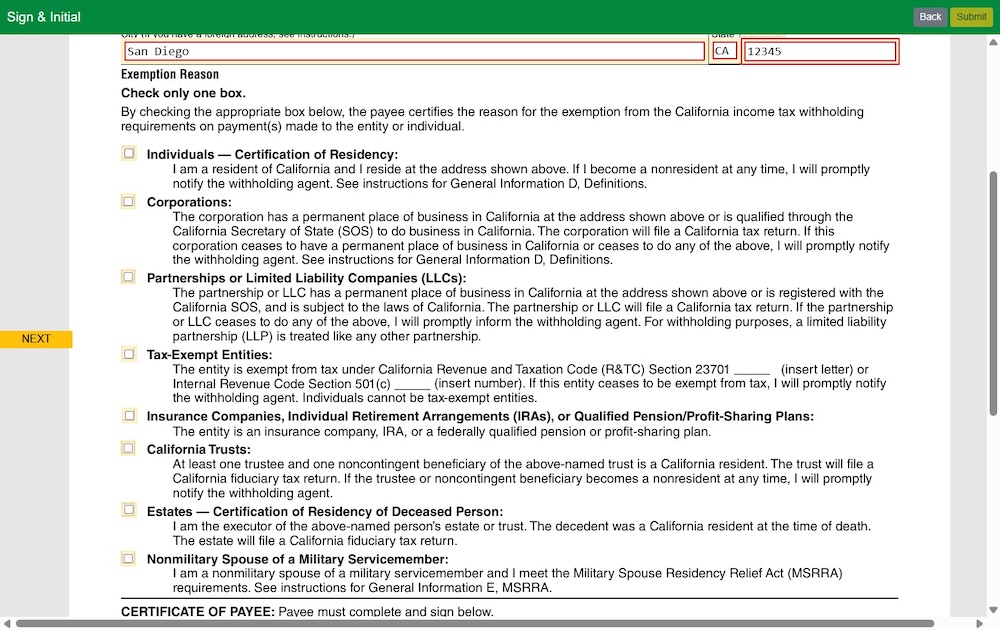

Choose from the exemption reason options that are applicable to you from the available list.

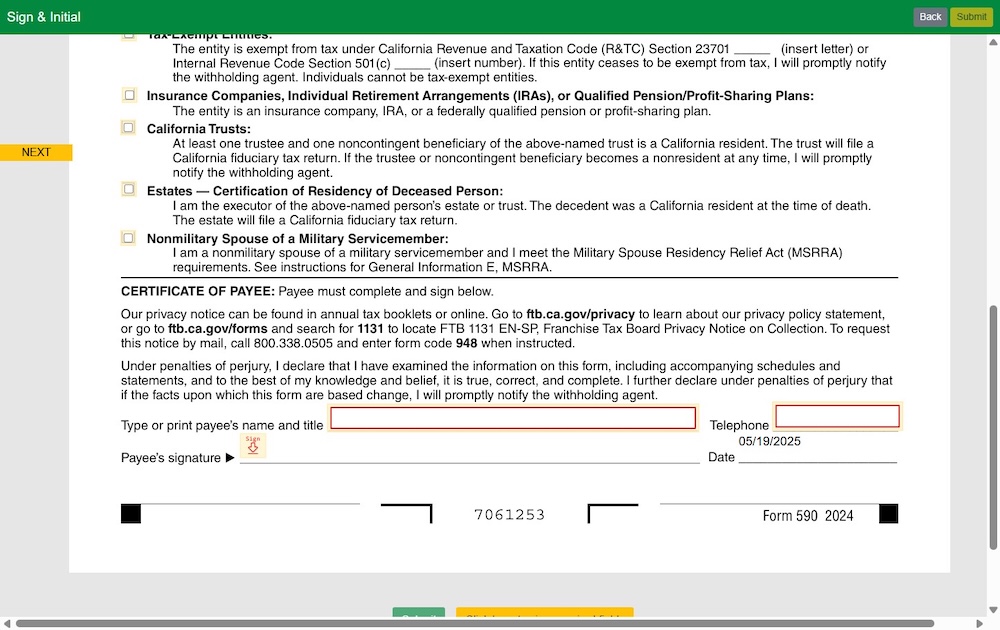

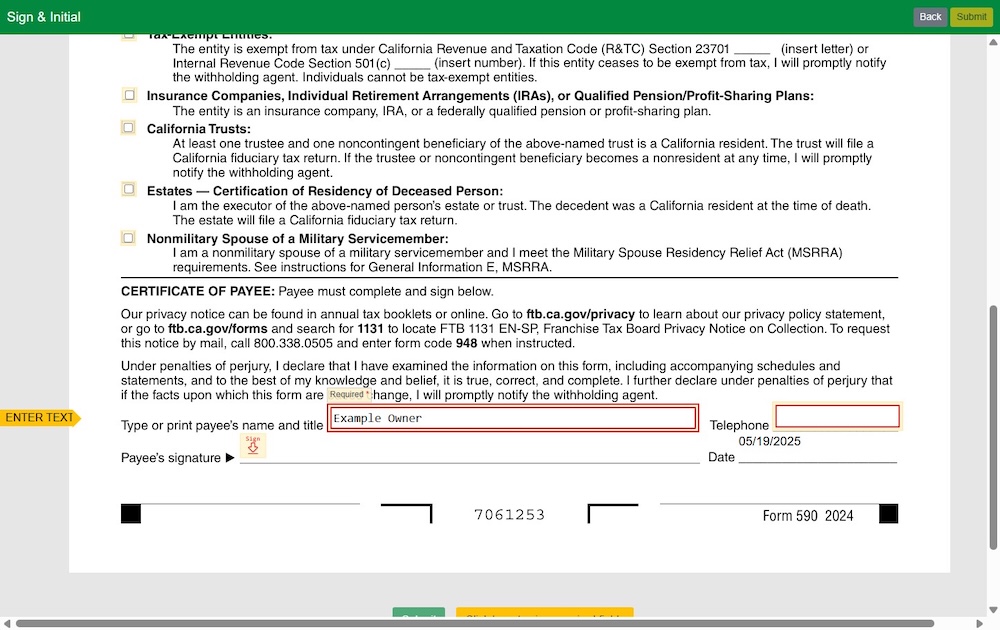

Enter your full name in the signature section of the form.

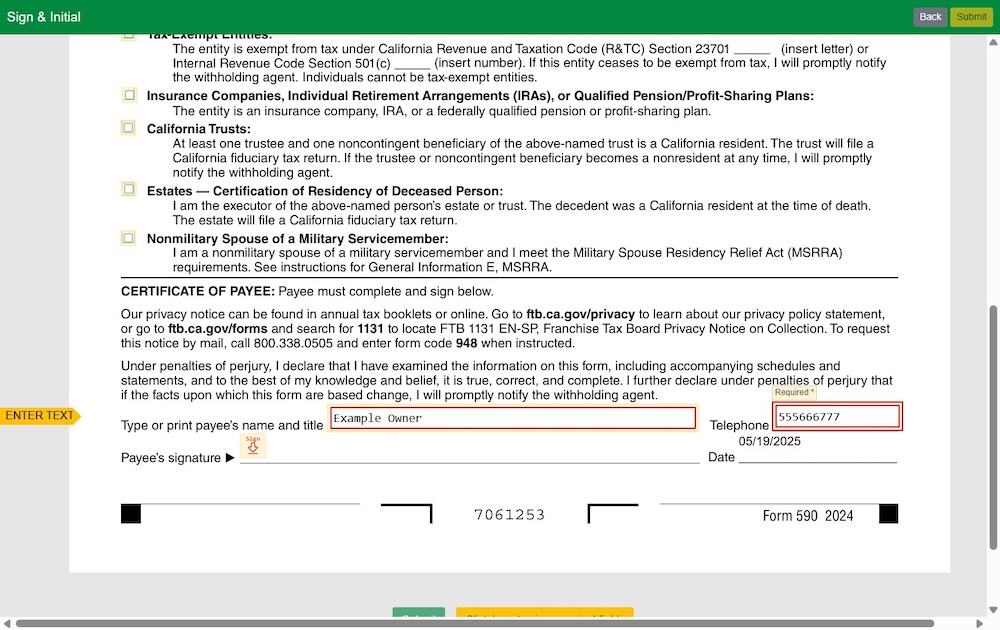

Enter your contact phone number in the designated field.

Apply your digital signature to complete the Form 590.

Complete the process by clicking the “Submit” button to finalize your Form 590 – Withholding Exemption Certificate.